Since 2013, Intellifi has conducted our Annual Commercial Mortgage Survey, collecting information with respect to non-development mortgage financing, from leading lending institutions across Canada. The survey collects data on new originations, market size, spreads, and risk appetites, amalgamating all the latest information to provide better insights and transparency to a historically opaque market. One of the highlights from the 2023 year-end survey was our analysis of the loan maturity profile of the current market, specifically with respect to the office asset class and the interplay between maturities and the current state of office origination volumes.

Our survey results estimate that $203 billion (45%) of Canadian commercial mortgage debt is coming due between 2024 and 2026, an average of $67 billion in each of the next three years. With interest rates sitting at multi-decade highs, borrowers are likely to face higher interest costs and lower leverage offers (due to loan-to-value and/or debt service requirements), which will restrict borrower ability to refinance their loans.

Office asset class

Diving deeper into the maturity data, indications are that up to $36 billion of those mortgages rolling over are on office properties. The relevance of this debt maturity is heightened when you consider the current lender demand for lending against office assets.

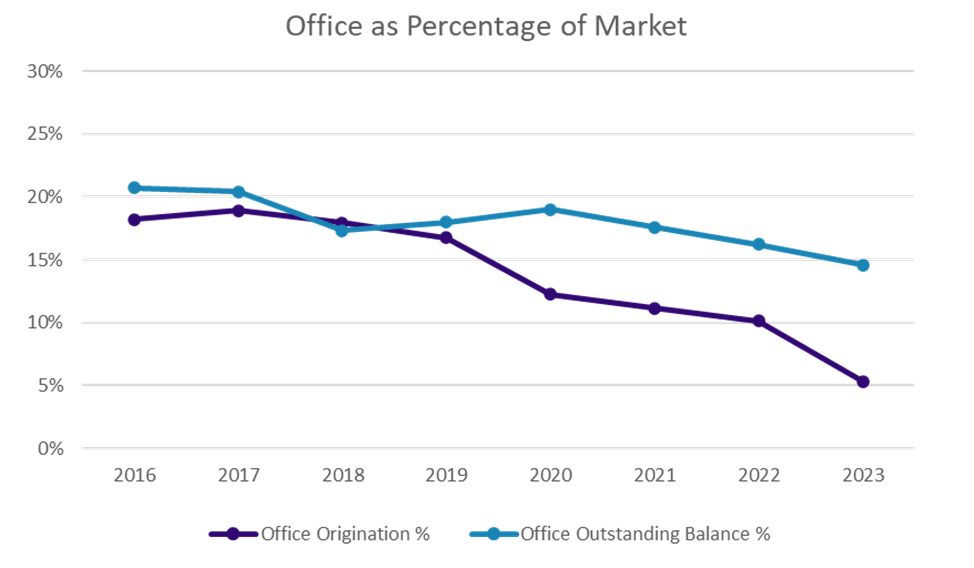

As of Q1 2024, the Canadian office market continues to grapple with changing work trends and economic pressures. These pressures have created an evident decrease in office as a percentage of origination in our survey results, dropping significantly since 2020, making up only ~10% in the 3 years following the start of the pandemic, with 2023 marking a sharp decline to only 5.3%, down from 10.1% in 2022. Prior to 2020, office mortgages made up roughly 18% of origination. Reviewing our portfolio size data, Office accounted for ~19% of outstanding balances prior to the pandemic but reached a low of 14.6% in 2023, down in each of the last 3 years since the pandemic began.

Office valuations, lender demand, and occupancy levels are likely to be lower than they have been for the past five years, making it more challenging for investors to obtain loan financing. With $24 billion in office debt coming due in the short term, this asset class should provide some unique opportunities for those lenders that are willing to trade risk for increased yields and the vast opportunity to put capital to work.

Market sentiment for other asset classes (multifamily, retail, etc.)

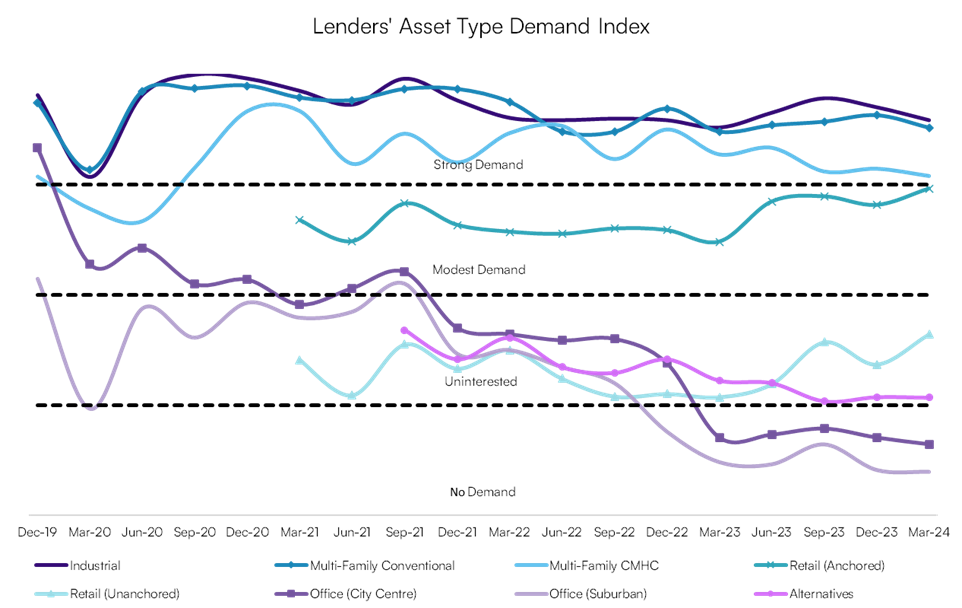

The Intellifi Lender Sentiment Survey is conducted quarterly to get a sense of lender appetites and interest across the Canadian lending landscape. The most recent report from Q1 2024 found that demand is mostly unchanged from the end of 2023. Demand for multifamily, industrial, and anchored retail maintained their spots as the most favored asset classes among lenders. One surprising shift in the quarter was the sharp uptick in demand for unanchored retail assets which has resurged on the surprising strength of retail in the post-pandemic era, a vast improvement since Q3 2022 when it was the least favored among survey participants. Office as indicated in the above, was the least favored asset class.

Prior to the pandemic, office was viewed among the asset classes with the strongest demand. According to our quarterly lender sentiment report, in the last quarter of 2019, 56% and 41% of lenders showed medium and high interest, respectively. However, in our most recent survey, no participants indicated any medium or high interest in the space.

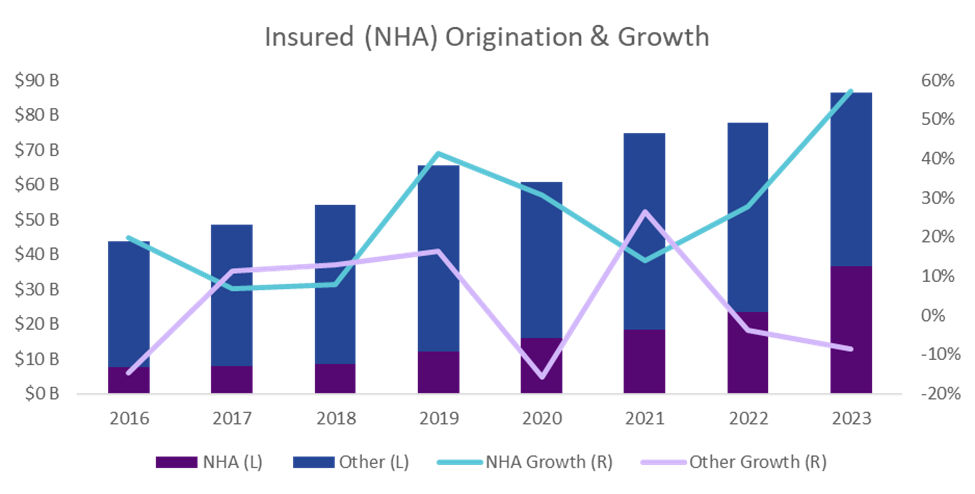

Origination and the rise of the insured mortgage

In Canada, our survey results estimate that annual commercial mortgage origination reached $86.4B in 2023, up 11.1% from the prior year. Most of this growth came from the insured commercial mortgage business, measured by the NHA Securitization Program, that has continued to grow at a blistering pace, up 57.4% in 2023 (5-year average growth rate of 34.2% per year). Last year insured commercial mortgages made up 43% of all originations in Canada or $36.7B. Without the insured business, origination in Canada would have shrunk by almost 9% year-over-year.

With the housing market still in crisis, the Canadian Government is further fueling the insured business, committing to another $1.5B in funding to support the construction of affordable housing. This will result in more capital availability and more activity within the space that is already funneling tens of billions into its existing programs. With further emphasis on affordability, CMHC’s MLI select program will continue to grow. If the insured mortgage business in Canada continues to grow at this pace, the Canadian origination market may soon be more than 50% comprised of insured mortgages.

*Originally published at https://renx.ca/lending-in-canada-a-closer-look-at-office-and-insured-mortgage-origination