In the post-pandemic era, we have been observing a shift in Canada’s commercial mortgage market from expansion mode to a market dominated by refinancing. Loans funded during the low-rate window of 2019-2021 are now rolling over into a higher-rate environment, with a large majority of today’s origination activity representing the replacement of maturing debt. We estimate that $262 billion ($87 billion annually) is scheduled to come due between 2025 and 2027, an amount that almost matches current annual origination levels. As a result, headline volumes look strong while net market growth stays modest, forcing lenders to crowd into a thin pipeline of genuine new loan opportunities and causing spreads to remain tight despite lingering macro uncertainty.

Conversely, the trends facing the multi-family market are moving in an almost opposite direction. Demand (or at least pent-up demand) for funding is strong, largely due to the necessity to combat Canada’s housing problem, the recent success of CMHC’s multi-family insurance program and the muted activity within the condo sector. However, the supply of capital, or at least the traditional supply of capital for this type of product, has been up against some pressure as it relates to the limitations of the Canada Mortgage Bond (CMB) program. In this article, we will discuss these dynamics in depth.

Robust Gross Lending vs. Modest Net Growth

Canada’s commercial mortgage market has been producing all-time-high loan origination levels, yet the increase in total outstanding debt remains muted in comparison.

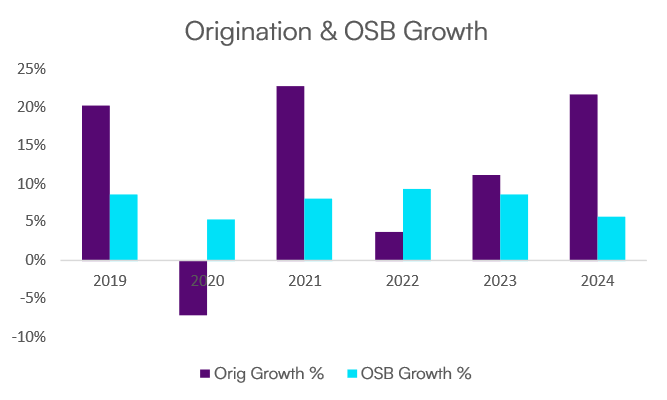

We estimate that total commercial mortgage origination in 2024 increased nearly 20% year-over-year, while total outstanding commercial mortgage debt in Canada grew by only 6%. This origination growth vs. market growth ratio lags what our historical data would indicate (Intellifi has a 15-year history of conducting our annual commercial survey – see Graphic 1). This implies that a large share of new loans was structured towards refinancing or replacing maturing debt, versus expanding overall credit.

Refinancing Wave and the Shifting Credit Landscape

The growing wave of loan maturities is becoming a major source of originations. While this suggests a robust pipeline of activity, new debt issuance has been constrained by many macro-level factors. Credit expansion today is being limited by broader economic uncertainty, elevated interest rates, and a lack of compelling new opportunities.

New opportunities are in part limited by new supply, exemplified by CoStar’s annual report, which notes that retail inventory growth in 2024 was just 0.4%, half that of the pre-COVID average of 0.8%. A similar trend is evident in the industrial sector, where new supply peaked in 2023 and has since declined, as developers adapt to softening demand. This broader supply slowdown sets the stage for understanding lenders’ expectations and the financing challenges ahead. According to our Q1 2025 Lender Sentiment Survey, lenders expect deal flow to slow across the overall market.

The Insured Multi-Family Sector

The surge in multifamily development in recent years, though still far from closing the long-standing housing supply gap, signals that new opportunities may emerge. This part of the market however is faced with the challenge in how these projects will be financed.

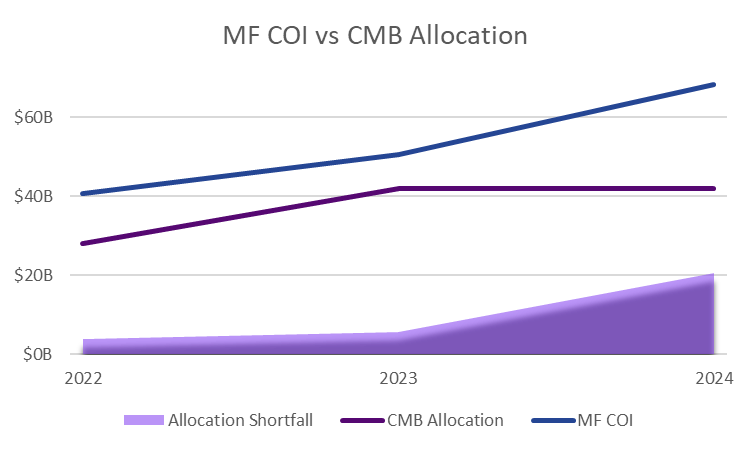

There has certainly been a lot of the proverbial “water cooler” talk in the real estate debt world surrounding the current state of the CMB program but not a lot of numbers to back it up. We have set out to try to solve for this. For context, it must be first understood that insured multi-family term lending in Canada is powered by the CMB program’s financing capacity. In simple terms, lenders fund these loans on a short-term basis via warehouse facilities and then sell them shortly thereafter through the CMB program. To access this program, lenders need to apply for CMB allocations and only term loans with a valid Certification of Insurance (“COI”) from CMHC are eligible for inclusion.

CMHC issued $50 billion in COIs for multi-family properties through Q3 2024, putting the full-year run-rate near $68 billion (CMHC, Q3 2024 Financial Results). This figure provides a good proxy to understand the market demand for capital for this type of lending with some adjustments as outlined below:

Other Debt Markets

Refinancing activity is also dominating other debt markets. According to Lysander Funds’ January 2025 Corporate Bond Newsletter, approximately 70% of the 2024 new issuance volume in corporate bonds was used to refinance existing debt, leaving net new supply “quite modest” and pushing yield-seeking investors to accept lower spreads. Across the board, refinancing needs remain elevated while true net issuance stays low—a trend playing out across many markets contending with COVID-era maturities.

Fierce Competition

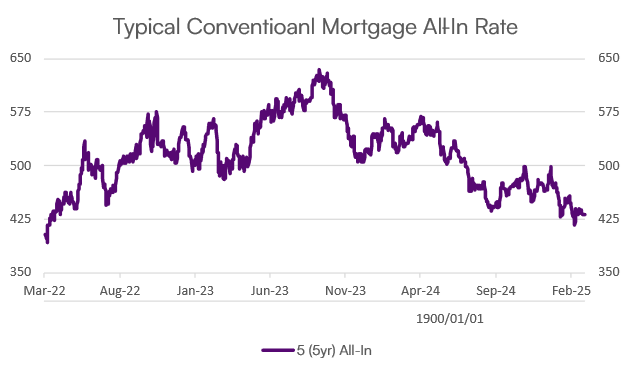

With fewer new sources of origination, lenders are increasingly competing for a small pool of high-quality assets, resulting in downward pressure on commercial mortgage spreads. Indeed, commercial mortgage spreads have shown lower volatility compared to other asset classes and continue to grind tighter. Spreads on the highest quality credit have been tightening, with all-in rates now well into the low 4% range, down from the mid-to-high 4% range seen toward the end of 2024. Notably, this trend persists despite heightened interest rate volatility and macroeconomic uncertainty.

This wave of increased competition is also shifting market share: Investment managers and credit unions are regaining ground, aggressively pursuing deals to meet yield targets, while traditional life insurance companies are beginning to lose market share due to lower risk tolerance.

Conclusion & Outlook

To summarize, Canada’s commercial mortgage market is being shaped more by refinancing needs than by expansion. This dynamic funnels lenders into a crowded chase for a thin supply of new opportunities, leading to aggressive bids with tighter spreads.

Regulatory pressures continue to restrict how freely banks can extend credit, limiting the flow of available capital into the market. Despite that, liquidity in the market remains high, driven by increased activity levels from credit unions and investment managers. A substantial amount of capital, including funds from stalled condo projects, is now looking for new deployment opportunities. With continued economic uncertainty, net new origination is likely to remain muted as new projects are halted and the existing supply cools off, preserving narrow credit spreads for the foreseeable future.

The demand/supply dynamic playing out with respect to the CMB program has already caused higher spreads and tougher searches for capital availability in the 5-year insured space. If this trend continues and pushes insured spreads wider, sources of capital outside of the CMB program for these projects will become more relatively attractive and frankly necessary.

A meaningful uptick in net new deal supply could ease competitive pressure and allow spreads to widen, but the path to this outcome is still uncertain and is not an easy fix for all asset types. Conversely, if interest rates remain elevated and large refinancing obligations run into difficulty, especially in challenged segments (e.g. office), lenders may tighten credit, and risk premiums could reprice. For now, ample capital chasing of limited new origination is likely to keep commercial mortgage spreads tight for the foreseeable future.

Looking for exclusive insights to stay competitive? Get involved in our upcoming surveys to access in-depth market intelligence and trends: Quarterly Sentiment Survey | Annual Commercial Mortgage Survey