Written and published by Aaron Goddard, CFA - Senior Director, Intelligent Lending Operations

Recently, I’ve read a number of summaries published by my peers in the industry following CMHC’s recent changes to its CMHC Multi-Unit Mortgage Loan Insurance Program (“CMHC MUL”) and found myself going down a rabbit hole of trying to answer the “Why?” as well as the potential implications on the market. This led to this piece where I reflected on recent changes in the CMHC MUL space and tried to provide some predictions on the market going forward. I certainly have no crystal ball and welcome any feedback, comments and questions – I’m just a DM away!

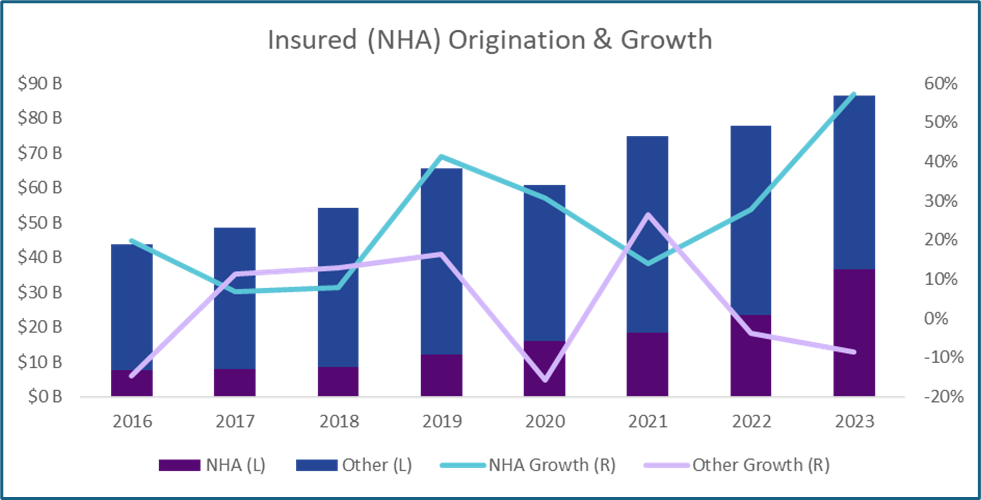

The significance of the CMHC Multi-Unit Mortgage Loan Insurance Program in the Canadian commercial mortgage debt market over the last 5 years cannot be overstated. Intellifi estimates that the CMHC MUL program was involved in more than 40% of all Canadian commercial mortgage originations in 2023, with that number expected to grow in 2024. The growth in the CMHC MUL program is summarized below as published in Intellifi’s 2024 Annual Commercial Mortgage Survey.

On June 4, 2024, CMHC announced a series of changes to the program going forward (Advice No. 253 for Approved Lenders). One of these changes represents a material shift in the CMHC Lender Correspondent program which previously enabled Canadian commercial mortgage brokers to submit insurance applications directly to CMHC on a CMHC Approved Lender’s behalf. This change will be effective on September 3, 2024.

Additionally, I put my thoughts down on the less publicized announcement from CMHC dating back to July of 2022 (Advice No. 18 for Approved Issuers) and its potential impacts on the market, especially when considering it in conjunction to the change to the Lender Correspondent program.

“Effective” elimination of the Lender Correspondent program

I write “Effective”, because the ability to appoint a Lender Correspondent by a CMHC approved lender will still exist going forward, but the ability for Lender Correspondents to submit applications directly to and correspond directly with CMHC ends effective September 3, 2024. Brokers, who owe their fiduciary to the Borrower, have been able to demonstrate value to their clients by controlling and negotiating the Certificate of Insurance (“COI”) directly with CMHC (the COI is what lenders rely on for a CMHC-insured loans). Furthermore, brokers would commonly “shop” the approved COI once in hand to other lenders to secure the best execution on behalf of their borrower clients. This would often require an Approved Lender to transfer their interest in a particular COI so that the Lender Correspondent could place the loan with the winning lender, another practice which appears CMHC is looking to apply restrictions to going forward.

Why did CMHC make the change?

The official stance from CMHC relates to “…reinforcing the responsibilities of Approved Lenders and address inconsistencies resulting from a decentralization of accountabilities.” Reading between the lines, I think safe to say that the quality of submissions from Lender Correspondents could vary widely (having been personally involved in this space I can attest to that conclusion). Let me just say that I know many brokers that provide just as good of an outcome, if not better relative to some Approved Lenders. What I think is the key piece for CMHC’s decision is a continued trend in a direction where they want to put as much onus and responsibility on enforcing CMHC policy on its Approved Lenders and what they realized is that the Lender Correspondent program was making that difficult to do so.

Market Implications

Pricing

The limitation of COI shopping may have some direct effect but I’m not sure it’s material. Capital availability for this type of product is vast across the market and the product is certainly in high demand. Increased costs for lenders and/or the previously mentioned Advice 18 may have some impact on pricing (more on that later).

Commercial Mortgage Brokers

My gut feel is that this change has a material impact on mortgage brokers. One of the key value-add propositions is soon to be very different – certainly I would agree with most of the recent LinkedIn posts I’ve read that mortgage brokers can still add value to the process, but I don’t think there is any denying that this change will have impact and CMHC wants its Approved Lenders to be more accountable for the insured loans that they fund going forward. I wouldn’t be surprised if CMHC’s Inbox is soon filled with Approved Lender applications from previous Lender Correspondents but obtaining Approved Lender status is not a given and comes with a cost – these brokers will need to ensure they have the infrastructure in place to adhere to the many requirements, including, amongst many others, a loan servicing solution. Oh! And let’s not forget about securing the capital required to fund these insured loans. For those same reasons, I expect to see some M&A activity in this space between brokerages and larger originator and servicer companies.

Lenders

Lender capacity is likely to be put to the test once direct communication between CMHC and Lender Correspondents is eliminated. Lenders will be expected to organize, submit, host interactions with CMHC, and process every COI it intends to fund which is not something all existing Approved Lenders are used to doing. Some very large insured lenders in the current market are used to getting 50%+ of their CMHC-insured origination through the commercial mortgage broker channel. That is not an insignificant amount, which means more capacity, training and energy will be required on the back-offices of some of these organizations. This will take time and will cost money which could have impacts on the capacity of loan applications these lenders are able to take on in addition to upwards pressure on their variable costs - all that points to a likelihood of increased pricing for borrowers.

Advice 18

Flying more under the radar these days is CMHC Advice No. 18 for Approved Issuers (as opposed to Approved Lenders). Approved Issuers have been approved by CMHC to pool eligible insured mortgages into marketable securities (known as NHA MBS) that can be sold to investors. Each Approved Issuer is assigned a maximum guarantee amount they can utilize - the annual guarantee threshold is currently set at $9 billion. Virtually all multi-family insured mortgages are financed through this funding vehicle. The point of Advice No. 18 was to limit certain issuers from an ability to originate loans over and above the maximum NHA MBS guarantee allocation amount available to other Issuers and/or avoid higher tier guarantee fees (applicable on guarantee allocations over the maximum amount).

Without getting too much into the weeds, certain originators were able to exceed their allocated NHA-MBS guarantee limits by effectively selling off loans to other smaller issuers and using those smaller issuers’ NHA-MBS allocations. These smaller issuers were happy to participate and make their allocations available because otherwise these allocations would go unused, and the selling originator was doing all the heavy lifting on their behalf. Going forward, unless these smaller issuers originate at least 50% of their own origination, they will be treated as an “Aggregator” in the eyes of CMHC, which in effect (and again, without getting into the weeds), closes the loophole that was previously being leveraged.

In a nutshell, Advice 18 is likely to have a material impact to the CMHC insured multi-family market because:

1) Larger originators who were accessing these smaller issuers to originate more loans every year will no longer be able to do so; and

2) Smaller issuers typically do not have the in-house capabilities, expertise, and infrastructure to originate and service on their own. So…do the rest of the market participants in Canada pick up some volume? I think so, but is that enough to fill the void? Do they have the capacity to do so? Time will tell but odds are this change also has impact on market pricing if the supply of capital (largely due to loan processing capacity constraints) is not there.

The Double-Whammy:

I like to think of the combination of Advice 18 and the changes for Lender Correspondents as a “Double-Whammy.”, and No, I'm not referring to the the relatively unknown 2001 cult classic featuring everyone's favourite Steve Bushemi.

Whammy 1: Lenders are effectively being forced to step-up their own origination and processing infrastructure either because they can no longer rely as much on the mortgage broker channel for support; or…

Whammy 2: Lenders need to avoid being treated as an “Aggregator” and/or are picking up the lending opportunities left behind because of the indirect consequences of Advice 18

This all needs to play out and I have no doubt that there will be unique variations of attempts made in the name of getting that next deal done – I’m looking forward to hearing the stories! And let’s not forget, these policies are always subject to change and CMHC has demonstrated in the recent past an ability to solicit and listen to feedback from market participants.

With change comes challenges. We here at Intellifi Corporation are eager to help lenders navigate these changes through our software and services solutions (shameless plug to follow below…).

Intellifi Offering

Our team at Intellifi is on a mission to ”Shape the Future of Lending”. We are an experienced group of commercial mortgage professionals who provide software and services to support participants in the debt sector.

We can help streamline lender operations through our proprietary technology and software as a service (SaaS) offering within our Orbit ecosystem. Through our Intelligent Lending Operations group, we can integrate with existing lender operations and support your loan origination, processing, and servicing activities.

Our loan processing software solution has already supported Canadian lenders with over $100B of transaction activity. Our relatively new Intelligent Lending Operations team has already successfully integrated with several lenders to support their due diligence and underwriting activities.

We are a dynamic team looking to engage and support clients in any way that we can. If you are a participant in the Canadian commercial debt market, let’s connect and show you in more detail what our solutions look like and brainstorm together how we can help you deliver on your objectives. Changes in our landscape such as these recent ones in the CMHC space are great opportunities to assess internal processes and consider new and dynamic ways to conduct business going forward.

Conclusion

Time will tell how these changes will impact the CMHC-insured mortgage market in Canada and if we’ve learned anything from CMHC in the recent past, they are not afraid to make changes in short order. Change in our world today is inevitable and has never been happening at such a rapid pace.

Lenders who take a dynamic approach with efficiency at its core but remain nimble and ready for change will come out on top; these are the core competencies of Intellifi, and we are excited to align with organizations who see the world like us.

Questions? Comments? Interest in discussing a partnership going forward? Please reach out anytime - aaron.goddard@intellifi.ca